18 lessons I've learned from the Crypto Market

Gm, friends!

It’s Monday, and we are all watching James Wynn’s giga positions on Bitcoin.

From being long Bitcoin, he has now flipped his bias to short (update: long again!)

Will he make it?

Today’s newsletter is brought to you by Mezo Network.

Mezo Network is redefining Bitcoin’s role in decentralized finance by introducing $MUSD, a fully Bitcoin-backed stablecoin pegged 1:1 to the US Dollar.

Unlike Ethereum’s DAI, which is collateralized by a mix of assets, $MUSD is exclusively backed by Bitcoin, allowing users to mint stablecoins, borrow, and earn yield while remaining entirely within the Bitcoin ecosystem.

This approach gives BTC holders the ability to unlock liquidity and access DeFi tools without selling their Bitcoin or relying on centralized custodians.

Mezo Network uses overcollateralization to maintain stability, with sustainable yields generated from real protocol fees, typically in the 1% - 5% range, rather than unsustainable token emissions.

There are no fixed loan terms, so users can repay at their own pace as long as their collateral remains healthy. Early adopters can deposit BTC into Mezo’s Pre-Launch Vault to earn rewards and future DeFi utility: https://app.pendle.finance/trade/pools/0x2e250f3e0ca772e87f0c9e2aa55254f7eb82ea58/zap/in?chain=ethereum

By depositing into the Pendle vault, you will start earning yield immediately, even before mainnet goes live.

Mezo and $MUSD aim to transform Bitcoin from a passive store of value into a dynamic, yield-generating asset for decentralized finance

18 lessons I've learned from the Crypto Market

1.

Don’t assume anyone has your best interests in mind.

Even if you feel like you're a part of a big community on crypto Twitter, you're all alone.

It's PvP (player vs. player).

When it comes to markets, everyone is self-interested.

2.

Information asymmetry on Twitter is extremely high.

Know where the influencers sit on the ladder to make good opinions for your own investments.

Follow the right people, and you can get a huge amount of alpha.

Follow the wrong ones blindly, and you may end up losing it all.

3.

Trust yourself:

When the market is up and you ask people what they're buying:

"You don't buy when the market is up, idiot".

When the market is down, and you ask people what they're buying:

"It's all over. You're an idiot if you buy now".

4.

Get away from echo chambers.

Use Twitter as a way to get feedback on your opinions instead of using it as a way to get confirmation bias.

Eg. if you're considering buying HYPE now, also seek information from those who don't recommend it.

Maybe you're overlooking something.

5.

Instead of arguing with anons online, your time is better spent reading whitepapers, experimenting with applications on chain, asking questions on Telegram/Discord, or documenting your thoughts.

You think best on paper.

Write down your investment thesis before you buy.

6.

Don’t let the thought of other people making money faster than you FUD you out of your conviction holds.

Your long-term holds have yearly time horizons, not weekly or daily.

However, be willing to sell if your investment thesis changes.

Never marry your bags.

7.

On trading:

If you’re getting euphoric about a position, sell.

If it goes parabolic, sell.

Nothing goes up forever, and if you want to survive long-term, you need to take profits.

8.

If you can't explain in two sentences where the yield in the DeFi platform you're in comes from, you are the source of the yield.

9.

Narratives are everything in crypto.

The stories we collectively tell are so powerful.

$DOGE and $SHIB at one point had a combined mcap approaching $100B.

Reminds me of the saying:

“Do you want to make money, or do you want to be right?”

10.

If you’ve seen a new crypto project and thought:

"Wow, that’s a great idea" but delay investing for weeks, do not throw money at it when it suddenly explodes in price.

Your opportunity to invest was weeks ago. You are now late and will buy the local top.

11.

Realize feelings are temporary. When you begin making money, you’ll feel truly euphoric.

The downside to this is that you’ll want to replicate that feeling again and again.

Overtrading and too much rotation can result from simply trying to replicate a feeling of ecstasy.

12.

Understand that every asset will have its time in a bull market (well, kind of).

I know you want to believe that everything will all go up at once, but there are more often phases where certain sectors outperform.

Watch out for emerging narratives and plan for them.

13.

Mistakes made in your 20s are better than mistakes in your 40s.

Mistakes involving $1K are better than mistakes involving $100K.

The first time I tried leverage trading in crypto, I lost a couple of thousand dollars in a matter of minutes. I learned from it and moved on.

14.

Why most people don't earn money in crypto:

1) YouTubers/big CT profiles write about a project/make videos (price goes up)

2) This token breaks into the top 100 on Coingecko

3) KOLs/VCs/early investors etc. starts selling on the way up

4) Now that the token is "known", normal people want to buy

5) Retail buys = price up a bit more

6) KOLs/VCs/early investors sell everything

7) Token dumps (typically while you sleep, right?) --> you sell at a loss

15.

Give yourself time.

We all want to get rich quickly.

But slow and steady wins the race.

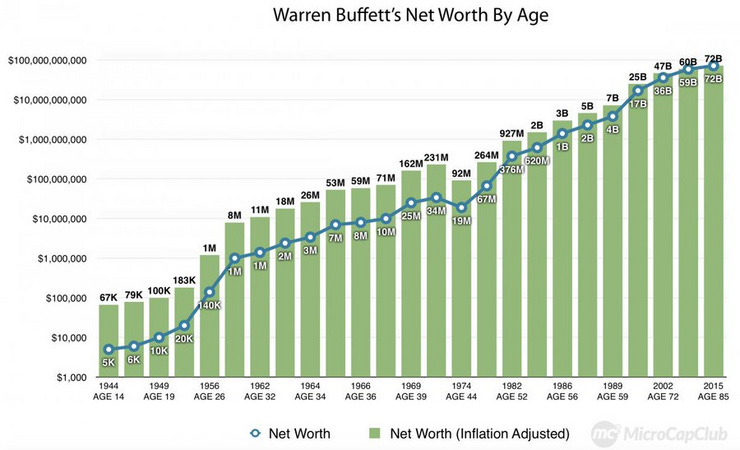

Just remember that $81.5 billion of Warren Buffett’s $84.5 billion net worth came after his 65th birthday - that's more than 96% of his NW.

16.

You don’t want retirement, you want freedom.

Retirement is like a beach holiday in the Caribbean.

Fun for a week, but then you're getting tired of it.

Freedom is waking up working on whatever you want, building things with cool people, and lots of time for family and friends

17.

If you really want to quit your safe 9-5 for going full-time in crypto, ask yourself if you're willing to be online 10-16 hours per day, 7 days a week for several years.

And even then there's no guarantee that you will make it.

18.

When you finally make it in crypto, you realize that it wasn't what you wanted in the first place.

You have money, but you're still the same.

Make sure to have more goals in life than money goals, otherwise, it's easy to end up getting depressed.

But that's for another day.