dYdX MegaVault

Hey, friends!

Today’s newsletter is a deep dive into dYdX’s MegaVault.

So what exactly is the MegaVault?

In simple terms, it gives you the ability to provide liquidity in an automated fashion on all dYdX markets and earn yield.

The vault aims for a market-neutral position by quoting both sides of the book - you effectively become a market maker.

But we will explore this in depth in this newsletter.

dYdX MegaVault

MegaVault Overview (game-changer for DeFi liquidity)

Introduction to dYdX

Since its inception in 2017, dYdX has been a trailblazer in perpetual markets trading. Consistently ranked among the top 10 in the sector, $250 billion in trading volume in the last 12 months., dYdX continues to outpace competitors through groundbreaking innovations and product iterations. Some highlights from this year include:

Isolated Markets: Isolated Markets on dYdX enable specific trading pairs to operate independently, mitigating risks and ensuring the stability of the broader platform. Importantly, they also provide traders with the ability to protect their collateral more effectively when trading riskier assets, by allocating collateral specific to the market. That way, if a position is under-collateralized and liquidation occurs, only the allocated collateral is affected and not the collateral in the trading account as a whole.

Prediction Markets: dYdX aims to let users trade ANYTHING, and in October of this year they made an important step in that direction by listing the first leveraged prediction perpetual contract. dYdX now supports trading eligible Polymarket prediction markets that meet liquidity and technical requirements. Users can long or short markets with up to 50x leverage, enabling higher potential gains (or losses). While Polymarket allows speculation on real-world events, dYdX prediction markets address limitations like capped upside by focusing on isolated margins and supporting 50x leverage. Traders can propose new prediction markets through the front-end widget, with markets tracking only the “Yes” share price for simplicity.

dYdX Apps for iOS and Android: The iOS and Android Apps are now pretty much at parity with the web experience, and also offer access to MegaVault. In its commitment to enhancing accessibility, the dYdX Ops SubDAO (DOS) has launched a beta version of dYdX (v4) on Android. This app mirrors the web and iOS experience, offering:

• 170+ markets

• Up to 50x leverage

• Low fees

• 24/7 trading

• Trading and staking rewards

• Access to MegaVault

MegaVault

The latest innovation from dYdX, which we’ll explore in detail today.

MegaVault is a user-friendly feature on the dYdX that allows users to deposit USDC, provide liquidity across various markets, and earn yield. The deposited USDC powers automated market-making strategies within dYdX markets.

Deposits can be made at any time, enabling users to start accruing yield immediately. Withdrawals are also flexible, allowing users to access their USDC whenever they wish.

Yield is derived from multiple sources, including:

• Profit and loss (PnL) on vault positions,

• Revenue shares from trading fees,

• Other community or software-deployer incentives.

Governance or software deployers can adjust parameters, such as the portion of trading fee revenue shared with MegaVault.

Initially, MegaVault will involve some manual processes, including:

1. Transferring USDC between market-specific "sub-vaults."

2. Adjusting "sub-vault" parameters that define the quoting strategy and behavior, such as the level of aggressiveness or defensiveness and the size of quotes.

These tasks are managed by an "operator" designated through governance. In future updates to the dYdX software, the need for an "operator" may be eliminated as the feature transitions to full automation.

It's important to note that yield is not guaranteed, as it depends on factors like market conditions and vault performance. For instance, a price drop when the vault holds a long position reduces its net equity, decreasing the value of depositors' ownership despite their percentage share remaining constant.

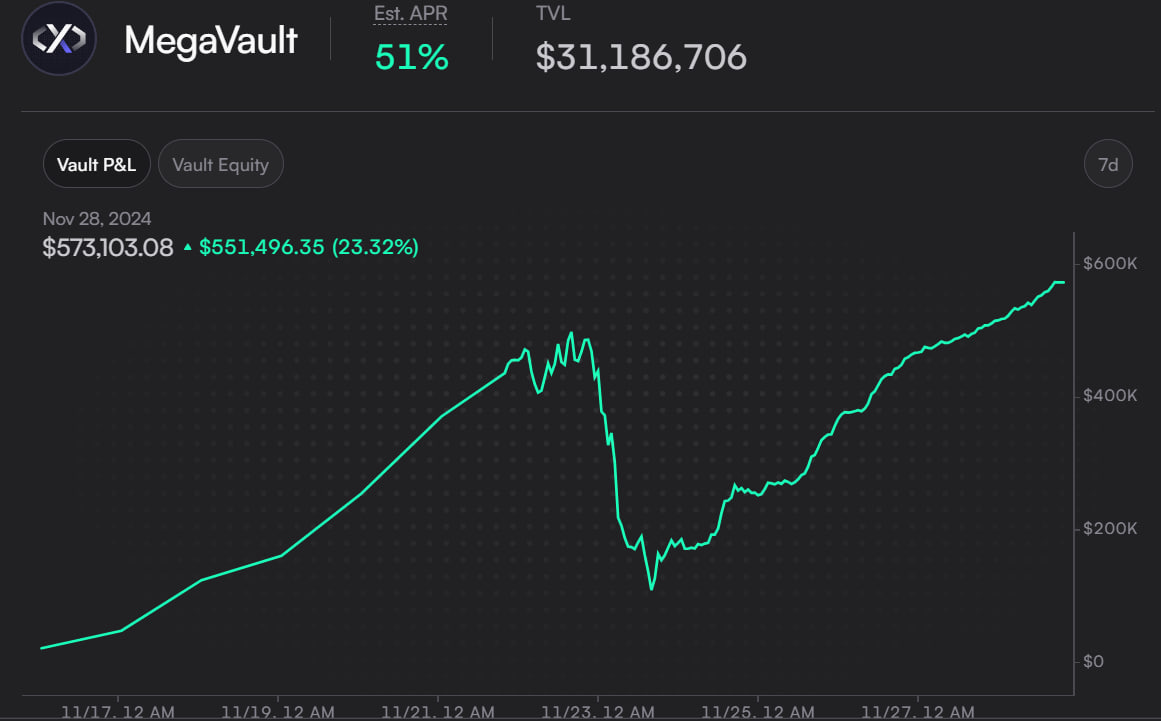

The MegaVault has already seen phenomenal growth in less than three weeks, growing to over $38M in TVL and already earning over $873K, with a current APR of approx. 50%.

Depositors effectively own a percentage of the vault's net equity (combining USDC and position values). In the initial version, withdrawals can be made anytime after depositing, though users may face "slippage" based on market conditions, vault status, and positions.

Future updates may introduce withdrawal restrictions, such as lockup periods for deposits tied to new market listings. For example, deposits linked to a market launch might be locked for a set number of days.

How to use MegaVault

I recently covered dYdX's MegaVault in my tweet here: https://x.com/Route2FI/status/1854643086900838417

But basically it works in the way that users can deposit USDC into a vault, contributing liquidity to the entire dYdX ecosystem. In return, they can earn yield derived from MegaVault's advanced market-making strategies and dYdX protocol fees.

Simply put: you provide liquidity; MegaVault generates returns.

Here is a step-by-step on how to use it in 6 steps:

1. Go to dydx.trade/vault

2. Connect your wallet (I use Rabby mostly)

3. Deposit USDC to dYdX

4. Approve and confirm

5. Deposit USDC into MegaVault (your deposit starts earning yield immediately)

6. Profit: You’ll earn a share of the profits from MegaVault’s operations and a portion of protocol revenue. Your earnings are added to your deposit balance.

At the moment it is 51% APY, but this can vary.

You can withdraw at any time.

Worth noting that MegaVault is the reason why new markets can be listed and traded permissionlessly. The liquidity from MegaVault is immediately disbursed to make the market tradable.

Think this pool can be a good strategy for some extra yield on your stables in the bull market.

With exposure across multiple pairs and neutral positioning, vault depositors are not only protected, but it also allows for liquidity to be distributed across multiple pairs, making dYdX more favorable for traders to use for more pairings, and therefore generating more fees.

Here you can see a great video that gives you the full introduction to dYdX’s MegaVault:

Instant Market Making with MegaVault

Liquidity is vital for trading, especially in long-tail derivatives markets, where it can be difficult to establish. MegaVault addresses this by acting as a global liquidity pool, seamlessly market-making across all dYdX markets.

No derivatives exchange has ever enabled instant token listings--until now. With Megavault, any market can be listed instantly with immediate liquidity. Anyone can create and trade leveraged markets, including cryptocurrencies, prediction markets, and more, with up to 50x leverage on dYdX.Trade the markets you want, not just the ones offered. This is how it should be.

It not only empowers users to provide liquidity but also offers a potential passive income opportunity. Depositors can share in MegaVault's profits and losses (P&L) while potentially earning a share of protocol revenue.

Beyond offering a simple way for depositors to earn yield on their USDC, it creates a virtuous flywheel: MegaVault boosts liquidity for newly listed markets, enhancing the trading experience for users, which in turn drives volume and increases fees. These fees are shared with MegaVault depositors, resulting in greater yields, attracting more liquidity and further improving the trading ecosystem.

Why Instant Market Listings Matter

Launching a market instantly requires depositing USDC into MegaVault. The vault then automatically quotes the market, ensuring liquidity from the moment it goes live. Here is how you can list a new market:

1. Visit https://dydx.trade/markets

2. Type in the asset name you'd like to list and select it.

3. Deposit your USDC and launch the market

4. Your USDC will be locked for 30 days to provide liquidity to the new market.

As part of dYdX's mission to decentralize trading, Instant Market Listings ensure full transparency and user autonomy. All order books, fees, and actions are fully on-chain, with no hidden mechanisms.

dYdX is redefining the possibilities of DeFi and leverage. Decentralization puts control in your hands, while leverage enables bold moves.

With MegaVault, anyone can list any market, making dYdX an exchange built by the people, for the people. With each upgrade, dYdX continues to set new standards for DeFi trading, reinforcing its position as a leader in the space.

…

All right, that’s it for today.

Stay safe in the markets, anon!

Ciao.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads