Gm, friends.

The crypto market has drastically changed, demanding new strategies and tactics as the previous ones we have learned don’t work anymore.

The traditional buy-and-HODL approach is fading as volatility reigns and new projects constantly launch, making long-term conviction challenging.

Now, it's about trading, constantly rotating the bags, and navigating a fragmented landscape where attention is fleeting and uncertainty is the norm.

Successfully adapting to this environment is key to survival and potential profit.

Let’s dive in and see if there is any hope left.

Before we start, let’s have a word from our partner dYdX:

Decentralized Finance (DeFi) revolutionizes financial services by leveraging blockchain technology, eliminating intermediaries like traditional banks. DeFi enables peer-to-peer transactions through crypto wallets, validated by decentralized networks, offering a range of services including trading, lending, and borrowing. Smart contracts, pioneered on the Ethereum blockchain, automate processes based on pre-defined conditions, enhancing efficiency and reducing human error.

Unlike centralized finance (CeFi), DeFi operates without third-party verification, relying instead on blockchains, smart contracts, and crypto wallets for security and privacy. Popular DeFi applications include decentralized exchanges (DEXs) for cryptocurrency trading, stablecoins for price stability, and platforms for lending, borrowing, and yield farming.

One notable player in the DeFi space is dYdX, a decentralized exchange built on Cosmos. dYdX offers perpetual contracts with high liquidity and low fees. It exemplifies the potential of DeFi to provide sophisticated financial instruments in a decentralized manner. The “2024 dYdX Ecosystem Report" revealed that DEX derivatives volumes reached a record $1.5 trillion in 2024, representing a 132% year-over-year increase.

DeFi's advantages include global accessibility, transparency, anonymity, self-custody of assets, community governance, and opportunities for passive income. However, it also presents challenges such as security risks from unaudited smart contracts, lack of insurance protections, and a steeper learning curve for new users. As the DeFi ecosystem continues to evolve, it promises to reshape the landscape of global finance, offering innovative solutions and greater financial inclusion.

Derivatives trading on decentralized exchanges (DEXs) is expected to surge to $3.48 trillion in 2025, more than doubling from 2024 levels. Trading volume grew by $270B, generating $45M in fees, and pushing dYdX close to $1.5T in cumulative trading volume since 2021.

Try out trading on dYdX here: dydx.trade

Altcoin Casino: How to Survive the New, Fragmented Cryptocurrency Market

The crypto market is experiencing a profound shift, particularly for those who entered the space within the last 12 to 16 months.

What once seemed like a relatively straightforward path to “semi” making it through trading on centralized exchanges has become increasingly complex. The landscape has transformed into something resembling a gambling arena more than a traditional trading market, demanding a level of agility and awareness previously unseen.

The traditional buy-and-HODL strategy, which once proved effective over periods of in earlier cycles, is largely obsolete. Holding periods have compressed dramatically, shrinking to mere weeks, sometimes even days (remember how OGs told us to just buy altcoins low and hold to sell at the top?)

This compression is primarily driven by the relentless emergence of new coins and projects, each vying for attention and capital, constantly challenging the dominance of established players.

You can read more about my thoughts on reflexity and dispersion among altcoins here:

Even events that would traditionally be considered positive can have unforeseen consequences. For instance, the highly publicized launch of a memecoin by Trump, might bring a surge of new users and attention to the crypto space as a whole, yet simultaneously devastate the value of many altcoins. The beneficiaries are typically limited to Bitcoin, Solana, and the specific memecoin in question. Many crypto holders have learned this lesson the hard way, experiencing significant portfolio losses if their holdings were not heavily weighted toward BTC and SOL.

A similar dynamic played out with the announcement of Berachain's launch, which negatively impacted the Abstract ecosystem as attention and capital shifted towards the shiny new platform. Given this highly dynamic and often unpredictable environment, the most prudent approach involves acknowledging the permanence of this volatility and understanding that it is likely to accelerate as the market continues to be flooded with new coins, chains, and projects.

Many investors are re-evaluating their strategies, increasing their holdings of BTC and stablecoins while significantly reducing their longer-term altcoin positions. The focus is shifting away from the idea of "investing" in altcoins for the long haul and towards a more tactical approach of "trading" them.

The goal is to avoid becoming the last believer in a failing project, holding on as its value dwindles to zero. Buying any coin other than BTC with a long-term thesis this late in the cycle may not offer a favorable risk-reward ratio. While a bottom for altcoins may be near, it is increasingly unlikely that most coins, NFTs, ecosystems, etc., will simultaneously surge to new all-time highs.

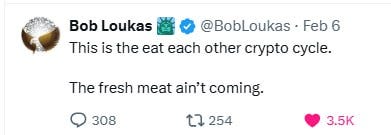

The sheer abundance of new coins launching daily dilutes attention and fragments capital, making it harder for existing projects to regain momentum.

Link to thread: https://x.com/Route2FI/status/1881662230472610178

This current cryptocurrency cycle is particularly challenging because of a pervasive sense of uncertainty that was less pronounced in previous market phases. A major contributing factor to this uncertainty is the lack of assurance that even popular altcoins will rebound after experiencing a significant dip.

In the 2017 and 2021 cycles, investors generally felt confident in buying dips in their preferred altcoins, provided they weren't invested in projects with minuscule mcaps (typically below $100 million). The prevailing belief was that these coins would eventually recover, at least for the duration of that particular cycle. The coins that gained traction early on tended to maintain their strength and relevance until the cycle's conclusion.

However, this cycle is different (yes, it is). It is characterized by a multitude of narratives and sub-narratives, each vying for dominance and fleeting attention. Investors are now far more cautious about buying dips, as there's a real and substantial risk that the entire narrative surrounding a coin could collapse, rendering the investment worthless.

Instead of one overarching cycle, numerous narrative-specific mini-cycles have emerged, each with its own rise and fall. Bitcoin and Solana are widely perceived as relatively safe bets for eventual recovery, but their potential returns may not be appealing to investors seeking exponential growth (at least after BTC has 6x’ed from the bottom, while SOL has 20x’ed. The question then becomes whether to invest in sectors like AI crypto, which, despite their recent popularity, have seen significant drops from their all-time highs and offer no guarantee of regaining their former prominence.

The fragmented nature of the market makes it difficult to identify and capitalize on these emerging trends with any degree of certainty. Crypto has always been a speculative venture, albeit one that past cycles attempted to legitimize with claims of peer-reviewed blockchains, solid fundamentals, and real-world adoption. This cycle has largely abandoned such pretenses, embracing a more nihilistic view that acknowledges everything hinges on capturing and maintaining attention. This has led to a shrinking attention span within the crypto space, where the "bull cycles" that once lasted a year or two have been compressed into mere months, weeks, or even days.

Currently, a meme supercycle appears to be in play (or is it dead now?), but with even the most popular meme coins experiencing significant drops from their peaks, the wisdom of investing in them is questionable.

The risk of being left holding the bag is higher than ever. In previous cycles, similar drops in coins would have been seen as buying opportunities, as their eventual recovery was almost certain. The question now is whether these coins will ever regain the attention they once commanded. The current market favors leaders over laggards, sidelining those who bet on undervalued sectors or projects with strong fundamentals but little hype.

While memes and AI have emerged as winners in this environment, there's a widespread hesitation to fully embrace these trends, as attention can shift rapidly and unpredictably. This pervasive uncertainty stems from the sheer number of options available to investors. With thousands of coins and projects vying for attention, it becomes increasingly difficult to discern which ones have genuine potential and which are simply fleeting fads. Attention is both fragmented and fleeting, making it harder to build lasting momentum. The fundamental question is whether this is the new normal for the crypto market or just a temporary phase brought on by the current market conditions.

Every cycle typically begins with a period of chaos and divided attention, eventually settling as clear winners emerge. However, there's also the distinct possibility that the market has fundamentally changed, with attention spans permanently shortened and no single narrative able to take hold for an extended period. Macro factors also play a significant role in shaping the current market landscape. The easy-money policies of the past made investing relatively straightforward, as abundant liquidity fueled speculative bubbles. However, with higher interest rates and tighter liquidity, the market is far more challenging.

The lack of confidence in buying dips may reflect these broader economic realities, as investors become more risk-averse in the face of economic uncertainty. Doubts about the traditional four-year cycle are common, with some predicting a lengthening of the cycle. However, despite these predictions, the four-year cycle appears to be persisting, albeit with some notable deviations from past patterns. The current cycle feels muted compared to previous bull markets, with Bitcoin only reaching about 1.5 times its previous all-time high and Ethereum not even touching a new ATH. The market movement can be largely attributed to specific factors, such as Michael Saylor's influence on Bitcoin and the introduction of Bitcoin ETFs, which have opened up the market to institutional investors. However, inflows are notably weak outside the Bitcoin ecosystem, with speculative capital largely drawn to meme coins that have accelerated lifecycles.

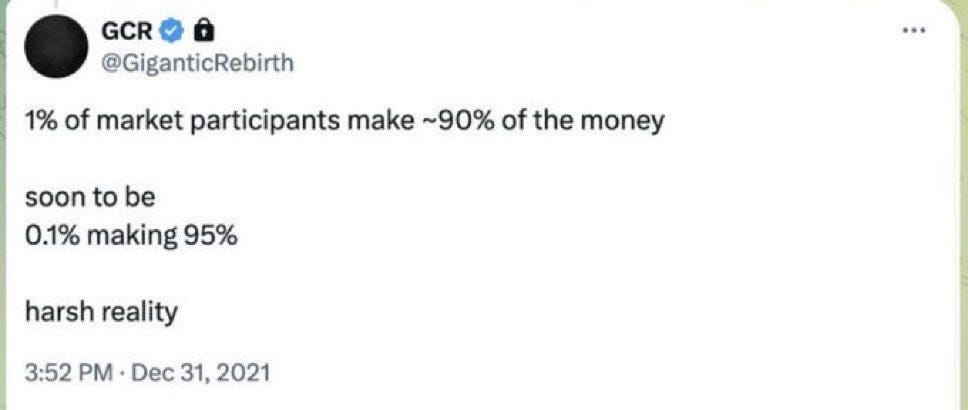

Broad-based speculative money appears to be largely absent from the market, and there's a lack of momentum to punch through to significant new highs across the board. Instead, the flows seem to be net flat, merely shuffling around within the existing crypto space. The absence of major liquidity providers means that these isolated areas of interest can't materially drive flows or collect substantial inflows from new investors.

The characteristics of this cycle simply don't align with those of previous bull markets, raising fundamental questions about the nature of crypto market cycles. The lack of broad-based speculative fervor, the concentration of gains in Bitcoin, and the recycling of capital within the crypto ecosystem all point to a market struggling to find its footing in a new paradigm. The forces that drove previous cycles, such as easy money and widespread retail enthusiasm, seem to be less potent in the current environment. The eagerly anticipated "alt szn," where virtually every altcoin experiences parabolic gains, remains elusive.

The BTC-TOTAL2 gap, which measures the difference between Bitcoin's market capitalization and the total market capitalization of all other cryptocurrencies, has been widening since the launch of the Bitcoin ETF. In previous alt seasons, everything pumped indiscriminately, driven by a tide of speculative capital. However, nowadays, BTC lives in a world of its own, driven by ETFs, Microstrategy, macro factors, and political considerations. The altcoin market can be viewed as a high-stakes casino, where one should only play when the casino has high net inflows and the right table is chosen.

For every winner, there must be a loser. The casino in 2025 is far harder to navigate than in previous cycles, with too many concurrent poker tables (i.e., different altcoins and sectors) and a proliferation of new tokens launched daily, each vying for attention and capital. The abundance of choice makes it harder to identify and capitalize on genuine opportunities, increasing the risk of being caught in a failing project. Navigating this complex and rapidly evolving landscape requires a level of skill, awareness, and agility that few possess.

However, some people still remain optimistic about an altseason, and I really hope they will be right.

That’s it for today.

Enjoy your weekend, and see you next week!

Want To Sponsor This Newsletter?🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads