Gm, friends.

The crypto world is changing, and we're starting to see where it's headed.

This involves new ideas, problems, and things that are becoming more or less important.

We'll look at how this market is growing and what the best chances are for success.

Before we start, let’s have a word from our partner dYdX:

dYdX has launched Surge, a one of a kind 9-month trading competition with $20 million on the line. Unlike other trading competitions that focus solely on high P&L or those with deep pockets, dYdX Surge is designed to reward everyday traders who are active across the dYdX ecosystem.

Like everything at dYdX, Surge is fully permissionless, there’s no need to sign up or manually claim rewards. All eligible trading activity on dYdX automatically generates reward points and a leaderboard ranking. Rewards are distributed at the end of each season. So in short:

Up to $20 million in DYDX incentives will be distributed over nine months. Your share will depend on your points and leaderboard ranking

Extra rewards are earned for staking DYDX, trading boosted markets, using the web or mobile apps, or returning as a past dYdX user.

dYdX Surge is permissionless. You don’t need to sign up or claim your points. Just trade to earn points and a ranking.

Learn more about dYdX surge here or visit dYdX to start climbing the leaderboard here.

The Evolution of Crypto: A Look at the Future of the Industry

As the crypto industry matures, its trajectory becomes clearer, shaped by innovation, challenges, and shifting priorities. Below, we explore key insights into how this dynamic market is evolving and where its greatest opportunities—and obstacles—may lie.

Speculation: The Lifeblood of Crypto's Core

At its heart, cryptocurrency serves as a revolutionary infrastructure for financial systems, much like the internet transformed access to information. Yet, despite its transformative potential, speculation remains the dominant force driving activity in the industry.

Whether through trading, lending, or derivatives markets, speculation generates the largest outcomes and revenue streams. While the pace and intensity of speculative activity may fluctuate over time, it continues to underpin much of what makes crypto tick. This reality suggests that while crypto’s utility may expand in the future, its speculative nature will remain central to its identity for years to come.

Stablecoins: Approaching a Tipping Point

The stablecoin market is nearing an inflection point as Circle’s IPO looms on the horizon. While stablecoins have long been heralded as a cornerstone of crypto adoption, their growth may soon plateau due to regulatory challenges and diminishing competitive advantages. Lower interest rates could further dampen their appeal.

The next wave of opportunities in stablecoins may not lie in global USD-backed solutions but rather in localized fintech applications that leverage crypto payment rails. Founders outside Silicon Valley—particularly those without access to massive early-stage funding—may find more success by focusing on regional use cases rather than attempting to replicate U.S.-centric models.

The Decline of Token Premiums

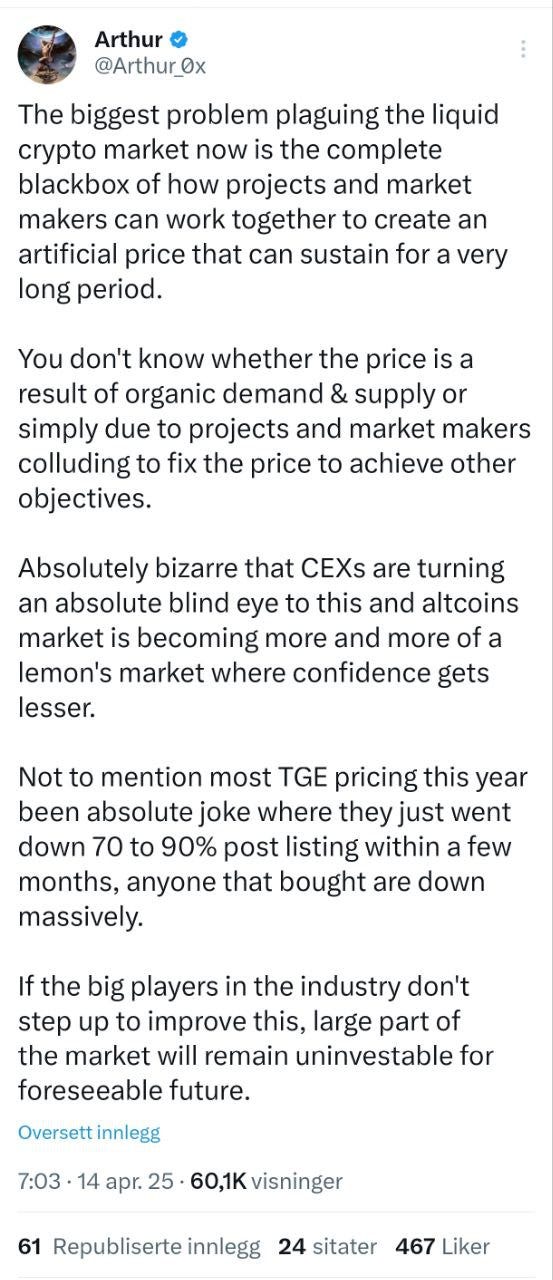

The market dynamics surrounding tokens have shifted dramatically in recent years. Once viewed as high-potential assets with significant premiums, tokens now face greater scrutiny from investors who prioritize tangible revenue streams over speculative hype.

Two major trends are driving this shift:

The collapse of token premiums in a post-bull-market environment, where achieving high valuations is increasingly difficult once vesting schedules kick in.

The disappearance of marginal bids as investors turn to traditional assets like stocks and currencies, which offer similar volatility with clearer directional trends.

Only a select few tokens—those tied to meaningful revenue—are likely to thrive in this new environment.

Venture Capital Faces a Reckoning

Crypto-focused venture capital is undergoing a paradigm shift as liquidity from token listings dries up. Historically reliant on retail-driven exchange listings for returns, many VCs are now grappling with a market where fewer founders choose to issue tokens at all. Instead, founders are opting to build smaller teams focused on generating sustainable revenue streams—a trend that challenges traditional VC models.

This shift reflects broader changes in the market since the collapse of FTX and other high-profile failures. As the industry adjusts to these new realities, only the most adaptable VCs will remain relevant.

Building Consumer Applications with Long-Term Vision

One glaring gap in the crypto ecosystem has been the absence of large-scale consumer applications akin to Uber or Instagram. While many attribute this to poor user experience or marketing failures, a deeper issue lies in how capital flows within crypto prioritize short-term returns over long-term product development.

To unlock the potential for mass-market consumer apps, founders must embrace longer time horizons and resist the lure of immediate token liquidity—a challenging but necessary shift for sustainable growth.

Crypto Meets AI: A Promising but Uneven Intersection

The convergence of crypto and artificial intelligence (AI) holds immense promise but has yet to deliver on its potential at scale. While concepts like provenance and distributed computing sound compelling in theory, they face significant scalability challenges when applied to real-world AI use cases.

One intriguing area of exploration is crowd-sourcing IP addresses—a model reminiscent of play-to-earn gaming that could unlock new possibilities for decentralized networks.

Banking Solutions for Crypto Natives

A niche but valuable opportunity exists in creating banking solutions tailored specifically for crypto-native users earning mid-to-high incomes (e.g., $5k–$20k per month). These users need comprehensive financial services that integrate payroll management, portfolio building (including traditional assets like stocks), and lending options—all within a crypto-friendly framework.

Although this market may be small initially (estimated at 5k–10k users), it represents untapped potential for innovative financial products.

Reviving DAOs Through Community Coordination

Decentralized autonomous organizations (DAOs) have struggled to maintain relevance as many users lose interest in governing platforms like lending protocols or derivatives exchanges. However, platforms like Farcaster could breathe new life into DAOs by enabling large-scale community coordination around shared resources and assets.

If successful, this approach could pave the way for more sustainable meme coins tied to community-driven value rather than speculative hype.

Crypto Gaming: A Sector Poised for Revival

Despite appearing dormant since 2022’s post-Axie Infinity downturn, crypto gaming remains one of the highest-potential segments within consumer applications. With sufficient time for stabilization and product development, 2025–2026 could mark a breakout period for games that combine engaging gameplay with sustainable economic models.

Founders willing to persevere through this challenging phase may emerge with millions of users and thriving marketplaces.

Talent Exodus: A Challenge Beyond Liquidity

As progress within crypto slows relative to AI’s rapid advancements, many talented professionals are leaving the industry altogether—a trend that could impact morale more deeply than price declines ever have.

In this environment, companies with strong cultures will stand out as beacons of hope, attracting top talent even during turbulent times.

Consolidation in Media and Research

Crypto-focused media and research are entering a period of consolidation as traditional funding sources dry up. The future belongs to firms that combine high-quality creative output with financial expertise and robust distribution strategies—a rare but valuable combination.

Private Equity’s Growing Influence

As fewer founders issue tokens and more businesses achieve significant revenue milestones, private equity firms are poised to play an increasingly important role in crypto’s evolution. Over the next 18 months, PE could become a dominant force in funding scalable projects with proven revenue streams.

Creativity Meets Crypto: Unlocking New Frontiers

There is untapped potential in combining creative industries—such as music, art, and writing—with crypto-native technologies to reach broader audiences at scale. Success in this space requires partners who understand both consumer distribution and the unique needs of creators.

Crypto continues to evolve at an extraordinary pace—both idealistic and morally complex as it reshapes global systems while grappling with new challenges. By focusing on data-driven insights and long-term strategies rather than short-term noise, innovators can help shape their next chapter while navigating its dual nature.

This post was hugely inspired by this post by Joel John, and you can read it here: https://x.com/joel_john95/status/1911755542718025760

…

That’s it for today.

See you next week!

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads