Hey, friends!

Today’s newsletter is a deep dive into Usual Money which is a project I am an advisor for.

Usual is a paradigm shift in DeFi, combining the best of traditional and digital finance.

Imagine a bank where you not only save but also earn shares. Usual acts as a decentralized bank, redistributing shares to its users through its innovative Liquid Deposit Token (LDT).

Enjoy the piece!

And make sure to check them out on Twitter too:

Usual - The decentralized RWA stablecoin protocol

Introduction

Centralized stablecoin issuers, like Tether and Circle, which represent about 90% of the stablecoin market, have become heavyweights in the crypto world, with valuations and profits defying traditional financial giants such as JP Morgan and BlackRock. Their business model is straightforward: they use the liquidity that backs the stablecoin to support various risk assets.

Consequent to the increase in monetary interest rates, these entities have transformed into lucrative “cash machines” Tether and Circle generated over $10B in revenue in 2023, with valuations exceeding $200B. None of this generated wealth is shared with the users who contribute to their success. Usual's goal is to empower users to become owners of the protocol's infrastructure, treasury, and governance. By redistributing 100% of the value and control through its governance token, Usual ensures that its community holds the reins.

The Usual protocol allocates its governance token to users and third parties who contribute value, realigning financial incentives and returning power to the participants within the ecosystem.

Usual is revolutionizing the world of stablecoins by introducing the features of a decentralized RWA Stablecoin. By depositing a yield-generating asset (initially USYC), users can gain a speculative yield tied to the protocol's success through Usual Governance tokens ($USUAL). This yield is designed to exceed the risk-free yield of the underlying asset. the mission is to transform stablecoin holders into profit owners.

Turn Users Into Owners

TLDR:

While traditional stablecoins like Tether exclude users from participating in both yield and growth, and yield-bearing assets provide exposure to yield but not growth, Usual offers the best of both worlds. With Usual, you gain access to both yield generation and growth potential.

The ownership-sharing mechanism ensures strong alignment between early contributors and the protocol by creating a positive feedback loop, positioning Usual to potentially capture a significant market share. By distributing ownership widely, the protocol rewards early participants and aligns the interests of all stakeholders.

Stablecoins like Tether collect users' cash, earning interest, while users are left out of both the yield and the issuer's growth. In exchange, users receive a token to use in DeFi but gain nothing from the profits.

What if users could benefit from all three—interest, growth, and utility—without compromise?

This is where Usual steps in: a decentralized stablecoin issuer where users are the owners.

There are currently three types of stablecoin issuers on the market:

Tether retains all revenue, directing it solely to Tether’s shareholders. Users have a DeFi-compatible stablecoin but miss out on both yield and exposure to the protocol's growth.

Yield-Bearing Stablecoins, issued by tokenizers like Ondo or Mountain, mark a significant evolution in the stablecoin landscape by redistributing underlying yields to users through permissioned stablecoins. Users get access to the yield but have no exposure to the protocol growth: whether USDM’s TVL is at $100m or $100bn, users still ‘only’ get 5%.

Usual goes beyond by redistributing value through the $USUAL token, which grants users ownership in the protocol. Unlike revenue-sharing models, Usual pools all created value into its Treasury, with 90% distributed to the community via the governance token. Users get both of all worlds: utility, yield, and growth.

This is how Usual turns users into direct owners, giving them control over the protocol’s infrastructure, treasury, and future cash flows.

Usual Token Infrastructure

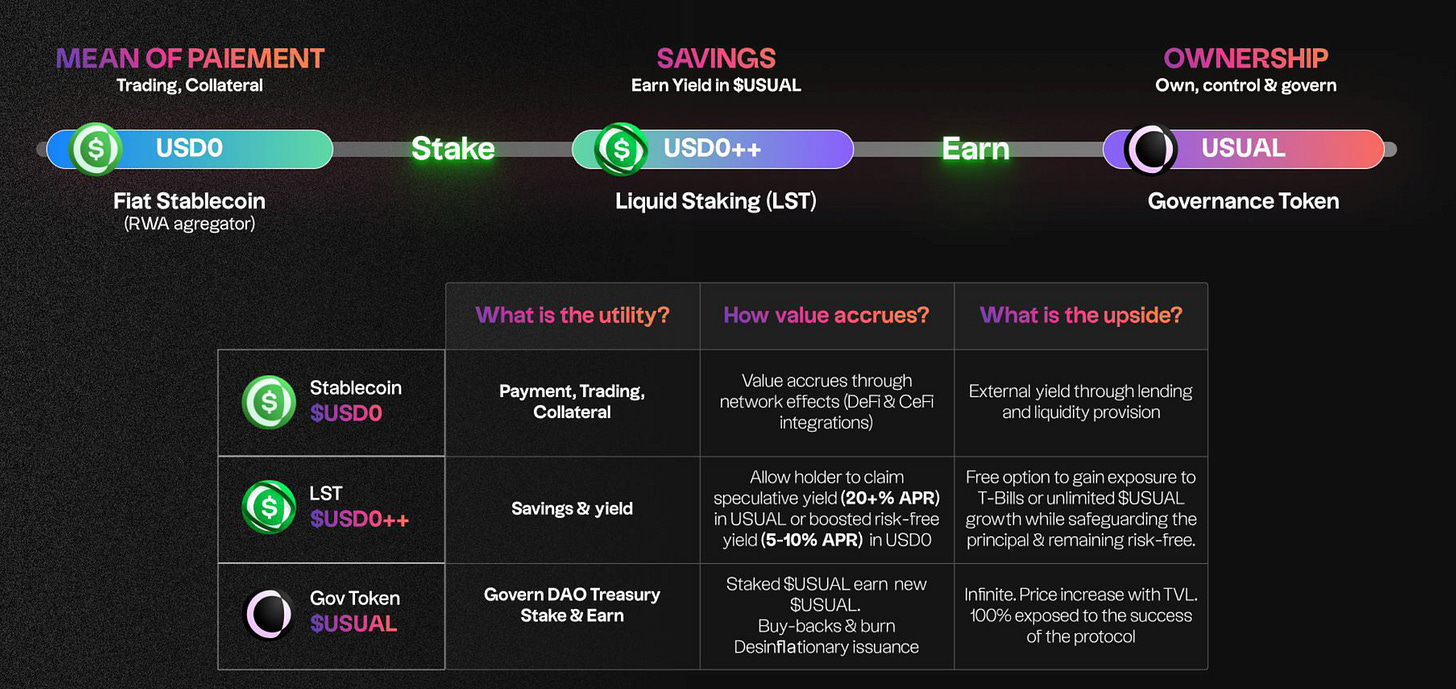

The protocol is structured around three tokens:

USD0

USD0 is Usual's USD-pegged stablecoin, designed to serve as a payment method, trading counterparty, and collateral token within the protocol. It offers a superior alternative to USDC and USDT while complying with US and EU regulations. This institutional-grade stablecoin is accessible to retail investors and DeFi users alike.

USD0 aggregates US Treasury Bill tokens to create a secure, bankruptcy-remote asset, unlinked from traditional bank deposits. It is fully transferable and permissionless, allowing for seamless integration into the DeFi ecosystem.

USD0 Liquid Bond (USD0++)

A USD0 holder who wants to make their stablecoin productive must stake it, getting a productive LST of RWA. USD0++ is a liquid representation of the staked USD0. By locking up their capital, the user gets the chance to claim $USUAL every day. If they haven't claimed their $USUAL, they can exercise a claim for a risk-free yield every six months. USD0++ is fully composable in DeFi, similar to USD0.

Therefore, USD0++ is an enhanced US-T Bill insofar as it entitles you to:

A speculative yield in the form of $USUAL, the governance token of Usual. The yield fluctuates depending on the price of $USUAL determined by the secondary market.

A boosted risk-free yield at minimum, based on the underlying T-Bill's monetary interest rate. This yield is boosted by the pro rata of the floating supply of non-productive USD0.

$USUAL - Governance Token - Benefits from adoption of USD0

USUAL rewards the growth of USD0, its adoption, and its usage within the ecosystem. The token represents the increasing adoption of USD0, aligning incentives with users who contribute to the expansion and utilization of the protocol.

The $USUAL token serves as the governance token within the Usual ecosystem, representing the earnings of the protocol and empowering users to participate in decision-making processes related to the protocol's operations and treasury management.

USUAL is built for long-term value growth, with its emission rate intentionally kept below the protocol's revenue growth to boost intrinsic value over time. In line with its community-first philosophy, 90% of the tokens are allocated to the community, with just 10% set aside for the team and investors.

Growth

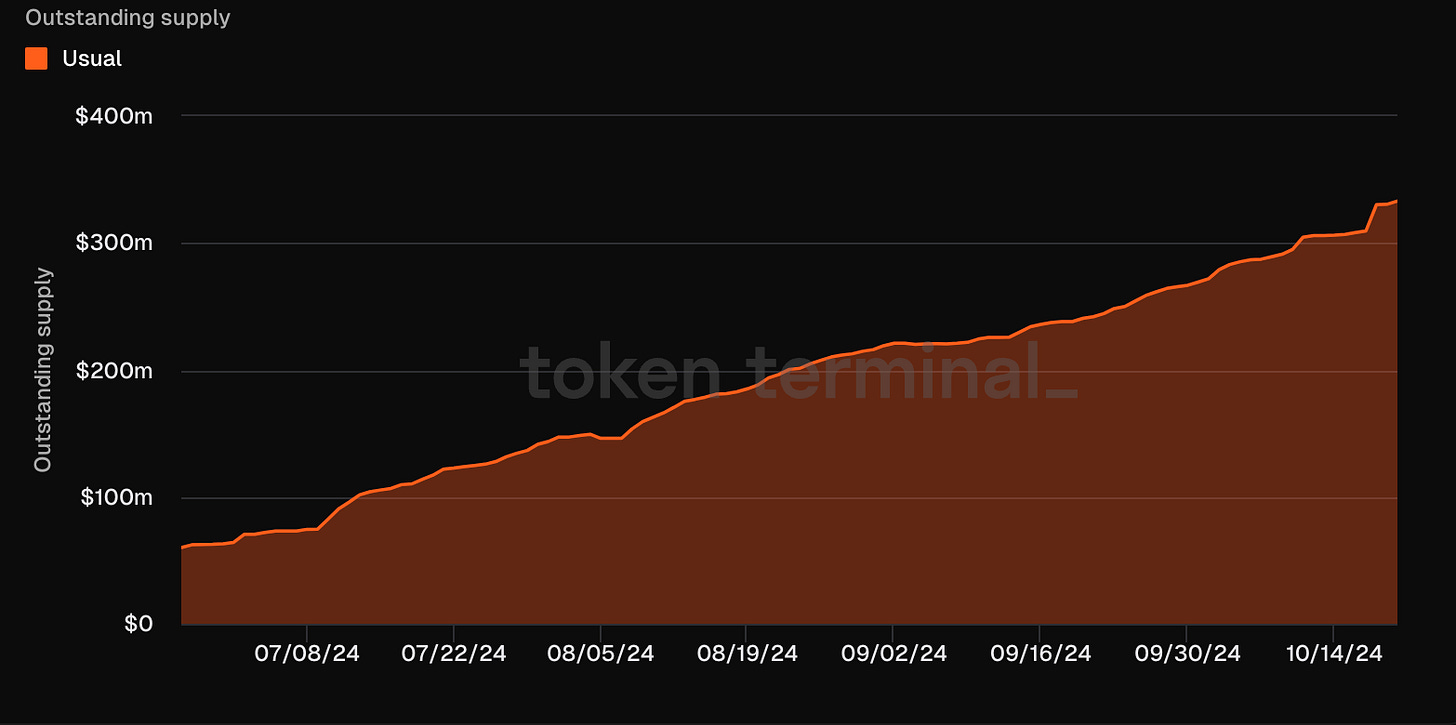

Usual demonstrated the highest TVL growth among stablecoins in the summer of 2024, ranking in the Top 5 Fiat-Backed Stablecoins:

Usual has experienced rapid growth, reaching $330 million in total value locked (TVL) within just three months. This impressive expansion made it one of the best-performing projects on Ethereum during the summer of 2024.

With over 40,000 users across various integrations, Usual has also become a top player in the stablecoin space, ranking as the 13th largest stablecoin issuer. Additionally, it is positioned within the top five pools on Curve, as well as leading in TVL on Morpho and Pendle.

The protocol is projected to generate $15 million in annual revenue, further solidifying its position in the DeFi ecosystem.

Team

Pierre Person, CEO Laywer, Advisor to the president, Former French MP, Vice President of Presidential Party set out on a journey 2 years ago to create a stablecoin protocol that embraces the true value of crypto and decentralization. When he was a congressman, he worked on developments towards a crypto regulatory framework in France. Twitter | Linkedin

Hugo Sallé de Chou, COO As a fintech entrepreneur, Hugo created a Venmo-like payment startup Pumpkin in 2014, challenging the traditional banking system and gaining 2 million active users at its peak. Twitter | Linkedin

Adli Takkal Bataille, DEO A true crypto OG who got in at block #271376 in 2013, he created a French-speaking crypto organization called Le Cercle du Coin and advised multiple projects as a consultant from 2018.

In 2020, he launched a crypto-native VC fund based in Luxembourg — Shift capital, now solely doing market neutral investments. Twitter | LinkedIn

Pierre Cumenal, CFO

Pete, with dual master's degrees in Applied Mathematics and Quantitative Finance, worked at Natixis and Amundi before moving to London as a quant at BNP Paribas. Here, he developed pricing models for exotic derivatives across various markets. Lately, he developed a fully decentralized options protocol.

Backers

Usual raised $7M via three rounds, now backed by 170 investors: VCs, Angels, Protocols, and DAOs.

Investors include Dewhales, IOSG, Kraken Ventures, GSR, Psalion, Hypersphere, LBank Labs, Public Works (Gitcoin co-founder), Kima Ventures, and Breed (former Circle executive).

A part of the 120 Angels includes Sam from Frax, Charlie and Michael from Curve, Defi Dad, DCF God, Chud, Lux Temple, Amber Group, Ivan from Gearbox, Convex founders, Zoomer Oracle, and more.

USUAL Tokenomics

Many governance tokens today suffer from flawed designs. They often follow unoptimized, copy-paste models, struggling to balance short-term traders with long-term buyers, which leads to selling pressure without sustained demand or utility growth. Additionally, these tokens show poor correlation between value, governance, and revenue potential, focusing on speculative trading rather than long-term utility, resulting in inflated prices driven by hype. Interests are often misaligned, with founders and insiders taking large shares of tokens, leaving users, who generate value, underserved and facing inflation that devalues their holdings.

Usual offers a stark contrast by aligning the interests of users, contributors, and investors for a sustainable value growth and real utility over the long term.

The USUAL token serves as the principal governance instrument within the Usual framework. At launch, the USUAL token grants holders both economic benefits and governance capabilities. Rewards are distributed to holders as $USUAL tokens, which have value from their economic rights on the real yield generated by the stablecoin collateral.

No VC Dominance: with 90% of the USUAL tokens are distributed to those who contribute value and revenue to the protocol, primarily through USD0 TVL. Contributors, such as investors, the team, and advisors, collectively hold no more than 10% of the total supply, shielding users from excessive dilution.

Emission Linked to Cash Flows: The issuance of USUAL is directly correlated to future cash flows generated primarily by the stablecoin’s collateral. USUAL is minted every time USD0 is staked, increasing the token supply in line with protocol revenue growth.

Controlling Dilution: Usual’s emission model is designed to be desinflationary, much like Bitcoin. The inflation rate is calibrated to remain below the revenue growth of the protocol, ensuring that token issuance does not outpace the protocol’s economic expansion.

Treasury Management: USUAL holders will also have the ability to decide how the treasury and protocol revenues are managed, through future mechanisms such as token burns or revenue distributions.

Gauge Voting: USUAL holders guide protocol liquidity and influence key decisions, ensuring their active role in the protocol’s growth and success.

Staking rewards: Token holders have the potential to generate income by staking their USUAL tokens. When USUAL tokens are staked, they become USUAL+—holding $USUAL+ grants the holder the right to receive up to 10% of the newly minted $USUAL tokens, following the specified issuance rules.

USUAL Distribution

The majority of $USUAL tokens are distributed to users who actively contribute to the protocol’s growth and value creation. The model is designed to protect the community from any dilution caused by the team or investors, ensuring that incentives remain aligned with those who drive the protocol’s success.

Detailed distribution

Emissions are split into various distribution channels (buckets) which can be modified by governance vote, each serving a distinct purpose:

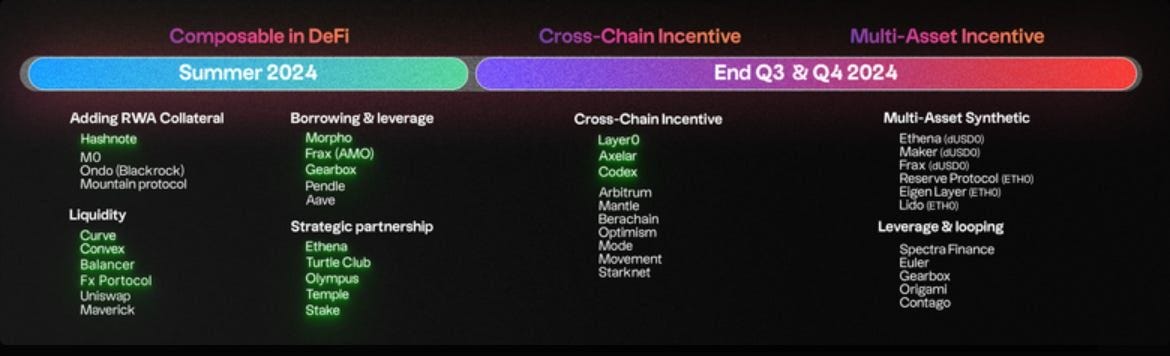

Partnerships

Integrations are the key for Usual to expand its TVL make it sticky and enhance its moat.

Here are the current integrated partners/in talks with, categorized for a better understanding of the Usual partnerships landscape:

Lending: Morpho, Euler, Term Finance, Sturdy, Arkis, PWD, Llamalend

Cross-chain: Chainlink, LayerZero, Axelar, Socket (discussion)

Yield: Etherfi, Pendle, Origami, Spectra, Equilibria, Penpie, StakeDAO

Restaking: Karak

L2s: Arbitrum, Base, BNB, Mantle, Starknet, Mode, Berachain, Monad, Movement, Sui

DEX/Liquidity: Curve, PancakeSwap, Balancer/Gyro, Maverick, Uniswap

Onramp/offramp: Banxa, Holyheld

Upcoming integrations: Morpho, EtherFi, Pendle, Symbiotic, EigenLayer, GainsTrade, Reserve, dTrinity, Polynomial, Bubbly, Hourglass, Superform, Brahma, Abracadabra, TimeSwap, Gearbox, Contango, DYAD, Idle, Notional, Exponential.fi, Curvance, Fluid, Thetanuts, Mach, GMX, Vertex, Bunni, vDEX.

Participate in the Pre-launch

The Pre-launch is Usual’s farming program, from July 10 to mid-November.

7.5% of the USUAL supply will be airdropped and distributed based on points earned during the Pre-launch. This system rewards users with daily points based on the Usual product they hold. Additionally, instant points are generated upon minting USD0++.

Here's how the point system works:

Daily Points:

USD0++ holders, 3 points are earned per token per day.

USD0/USD0++ Curve LP holders, 3 points are earned per day per USDO deposited.

USD0/USDC Curve LP holders, 1 point is earned per day per USDO or USDC deposited.

Many other opportunities exist such as Pendle, Morpho, etc.

Visit the Usual dApp to see the various ways to participate, notably via Pendle, Etherfi, Morpho, Curve, Equilibria, Karak, and others.

…

All right, that’s it for today.

Stay safe in the markets, anon!

Ciao.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Banger Article, ser.