Hey, friends!

We are still in a bull market even though we have “cooled off” a little bit.

In earlier cycles we have sold off a little bit before the halving. Will this time be different?

Anyway, today’s newsletter is a deep dive into Vertex Protocol (disclaimer: I am an investor), which falls under the DEX narrative (a sector I think is massively undervalued, and I am pretty sure that most coins will be 10x at the end of this cycle from today’s prices).

All right. Let’s jump right to it!

Vertex Protocol - Self-custody like a DEX, trade like a CEX

Introduction

Hey, anon.

It’s a fact that over 90% of crypto uses CEX’es from their crypto trading today. While CEX’es has their advantages, there are two major drawbacks that makes people highly skeptical about them: how is the funds handled by the CEX, and secondly, self custody. Since you don’t have custody of your assets, in the event that the company goes bankrupt or if the company owner decides to steal the funds, there is nothing the user can do since the platform technically has custody of the assets.

Vertex is a cross-margined decentralized exchange (DEX) protocol offering spot, perpetuals, and an integrated money market bundled into one vertically integrated application on Arbitrum.

Vertex is powered by a hybrid unified central limit order book (CLOB) and integrated automated market maker (AMM), whose liquidity is augmented as positions from pairwise LP markets populate the orderbook. Gas fees and MEV are minimized on Vertex due to the batched transaction and optimistic rollup model of the underlying Arbitrum layer two (L2), where Vertex’s smart contracts control the risk engine and core products.

The integrated AMM is located on-chain – housed within the protocol layer. The orderbook matches inbound orders with execution speeds between 10 - 30 milliseconds, competitive with most centralized exchanges (CEXs).

The pooled liquidity of the AMM sits alongside the bids and asks on the Vertex orderbook, effectively another market maker contributing to liquidity via smart contracts rather than API. The AMM liquidity is combined with liquidity from automated traders via the sequencer, and users trade against this unified source of liquidity.

A user’s portfolio (i.e., multiple open positions’ liability) is shared across a single trading account to offset the margin between open positions. Calculations of portfolio health are performed automatically, and available capital is deployed to manage the margin requirements of open positions across the three primary products:

Spot

Perpetuals

Money Markets

With single, universal trading accounts, traders can deploy complex strategies (e.g., basis trades) requiring multiple open positions with simplicity and lower margin requirements.

Vertex also has a nice referral system: https://app.vertexprotocol.com/referrals

Refer a friend, get 10% of the rewards (your friend will also earn 10%).

Mission

The blow-up of FTX in 2022 showed us how important it is to have control over our own assets.

Decentralized exchanges (DEXs) give users control and autonomy to mitigate the principal-agent problem of spurious centralized actors like FTX. Opacity and trust in a third party are eliminated as users retain self-custody of their assets on permissionless networks where transparency, decentralization, and veracity are intrinsic elements of the underlying blockchain.

Below you can see a short video of Vertex’s mission on how to take back control from centralized exchanges:

Issues with DEX trading today

Even in the wake of recent revelations, centralized exchanges (CEX) still dominate crypto trading volume. Offering users more product features, fiat on/off ramping, lower latency, and better liquidity, CEXs remain the premier venues for trading crypto assets. The scalability, UX, and capital efficiency barriers of incumbent DEXs for the average user only compound the advantages that CEXs maintain.

To expand a little bit: CEXs offer an easy on-ramp and off-ramp with fiat which simply isn’t attainable with DeFi. Another issue is liquidity. The CEXs have all the liquidity in one place, but in DeFi there are multiple chains, multiple exchanges, and multiple different solutions for one problem. This creates fragmented liquidity making it difficult and inefficient to use DeFi. Users will have issues with slippage leading to worse execution and it's just not an optimal solution in general.

DeFi-native trading has yet to fulfill its full potential. It is time to change the narrative.

No longer should users be forced into trade-offs between control and performance when evaluating whether to trade on a CEX or DEX. Vertex’s mission is to bring the performance and features of CEXs on-chain while preserving the benefits of self-custody, transparency, and decentralization native to DeFi.

Vertex is a DEX on Arbitrum bundling spot, perpetuals, and an integrated money market into a unified trading platform. Trade with lightning-fast speed, universal cross-margin, and a customizable, user-friendly trading interface.

Vertex unleashes the performance and usability of centralized competitors – on-chain and always self-custodial.

Vertex Edge

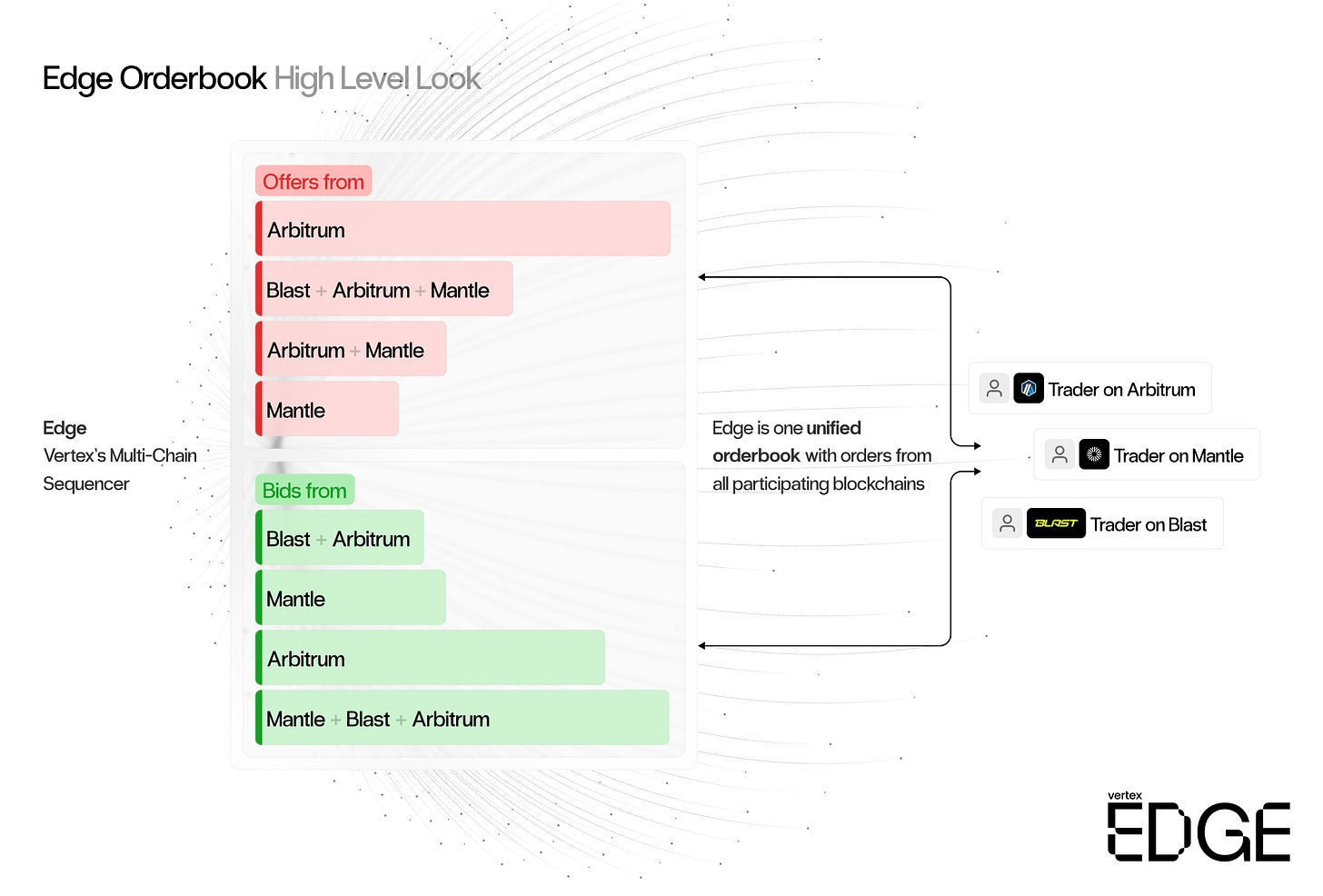

Vertex Edge is a synchronous orderbook liquidity product for unifying cross-chain liquidity across different chains.

You can consider Vertex Edge as a network of highways connecting isolated liquidity islands.

This superhighway of liquidity among the islands doesn’t just connect these islands; it merges them into a continent of shared liquidity.

Orders from different blockchains are matched with unprecedented efficiency, thanks to this interconnected liquidity web.

You can think of each inbound order from a Vertex instance as a request to modify a balance on-chain. As a result, settlements are just rendered on the specific chains (e.g., Vertex on Arbitrum) where the corresponding balances need to be altered.

Orderbook liquidity on the non-Arbitrum instance, such as Blitz, is injected into a synchronous orderbook, fusing the liquidity together from both Vertex on Arbitrum and Blitz on Blast.

Let’s do an example, because it’s always easier to understand with a real perspective:

Assume there are two Vertex instances (Arbitrum & Blast).

Alice submits a market order (taker) on Blitz, to long the ETH-PERP at price $3,500.

The sequencer (Edge) matches the order against the best liquidity after examining the orders aggregated across the two Vertex instances on Arbitrum and Blast.

The best offer is from John who is trading on Arbitrum.

John is now short ETH on Arbitrum.

Alice is long ETH on Blast.

In the middle, the sequencer (Edge) takes equal opposing positions on each chain. Edge is now short on Blast and long on Arbitrum.

Edge injects Alice’s matched order into the sequencer queue of batched orders to render and settle on-chain to Blast — simultaneously sending John’s order to be settled on Arbitrum.

Over time, Edge will continually build long and short positions on local chains.

Periodically, liquidity between chains will be aggregated and settlement will be made on the back-end.

The outcome is that liquidity fragmentation across chains is supplanted by additive, positive-sum orderbook liquidity on a single layer spanning multiple chains.

Basically, this means that you get better liquidity, you will get faster filled because the sequencer (Edge) is now seeking liquidity from not only Arbitrum, but also on Blast.

This was a long introduction, but let’s look more at Vertex Protocol and all its features.

What is Vertex Protocol?

The aim of Vertex is to provide the most frictionless trading experience possible without compromising on transparency and self-custody.

Btw, the name Vertex comes from the fact that it is a vertically integrated exchange.

Vertex is a cross-margined decentralized exchange (DEX) protocol offering: spot, perpetuals, and money markets in one vertically integrated application.

But what is a DEX in the first place? Well, a decentralized exchange (DEX) is a cryptocurrency exchange operating on a decentralized network like Ethereum. It allows for peer-to-peer (P2P) trading of cryptocurrencies without intermediaries, such as centralized exchanges.

DEXs usually operate under two models: automated market makers (e.g., AMMs like Uniswap) and central-limit orderbooks (e.g., CLOBs like dydx).

Vertex is powered by a hybrid model: unifying the central limit order book (CLOB) and AMM to provide optimal liquidity and access for all users.

Vertex’s products

These include:

Spot Markets

Perpetual Markets

Money Market

Spot markets refer to the buying and selling crypto assets for immediate delivery and payment. In other words, buying a crypto asset on an exchange’s spot market, with immediate settlement.

Vertex’s spot markets allow you to buy or sell listed crypto assets paired with USD-denominated stablecoins. All spot assets on Vertex are quoted in USDC.

Perpetual futures contracts are derivatives that allow users to speculate on the price movements of crypto assets without taking delivery of the underlying asset. In contrast to conventional futures contracts, perpetual futures never expire and can be held indefinitely.

The contract price is tethered to the underlying asset’s spot price via funding rates. Funding rates modulate the incentive to trade long or short by assigning a positive or negative carry cost to a specific perpetual position.

I wrote about funding rates in detail here, check out the post if you want to learn more:

When a perpetual’s price is higher than the spot price, traders with long positions (i.e., those betting that the price will go up) must pay a funding fee to traders with short positions (i.e., those betting that the price will go down). This funding fee helps to bring the perpetual price back in line with the spot price.

Conversely, when the perpetual’s price is lower than the spot price, short traders are required to pay a funding fee to long traders, incentivizing the opposite behavior.

Vertex’s trading fee model is competitive with centralized crypto exchange venues – offering cheap trading for takers and zero fees for makers on major pairs like BTC/USDC and ETH/USDC for both spot and perpetuals.

Specific to Vertex’s orderbook, the maker/taker trading fee model is displayed below.

Money market is where users can borrow spot assets automatically using their portfolio margin to secure loans.

Depositors are the liquidity providers (LPs) to the pool, earning a proportional share of the prevailing interest rates paid by borrowers – presenting a mechanism for passive yield on deposits.

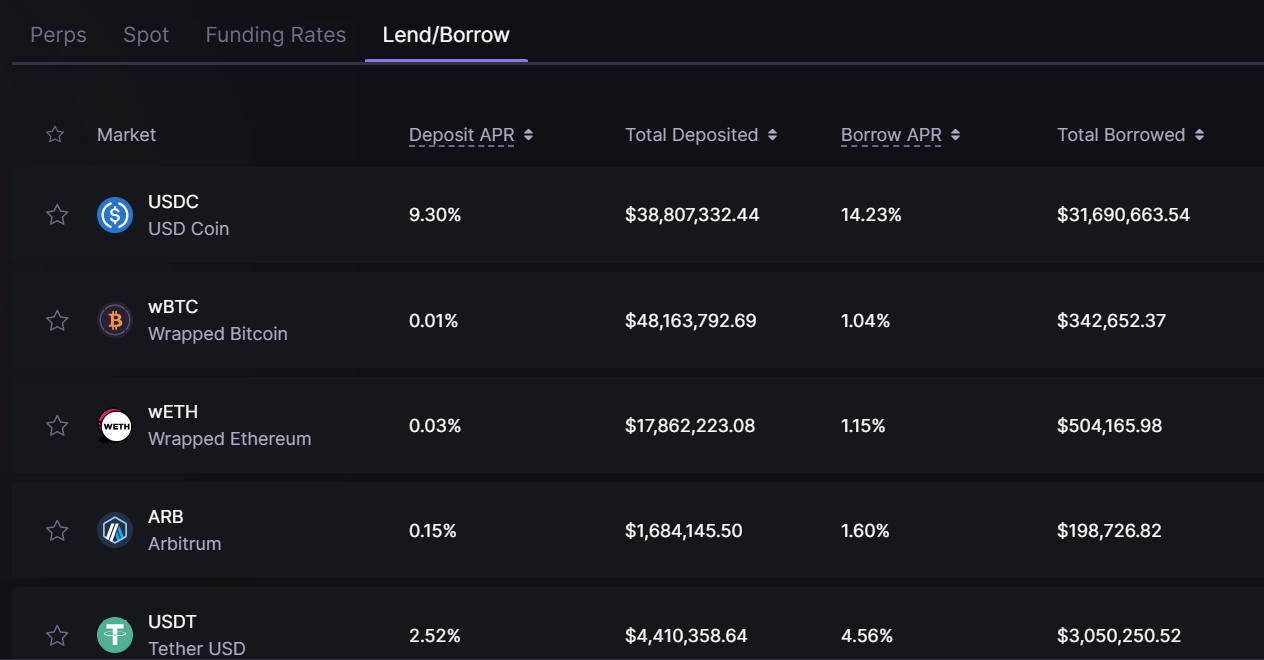

Below you can see the interest rates for deposits and borrows. The interest rate in a decentralized money market is determined by the supply and demand of assets. Borrowers must provide a certain amount of collateral in crypto assets, which must be maintained at a predetermined minimum level during the loan period. This collateral is held in a smart contract until the borrower repays the loan.

Hybrid Orderbook AMM Design

The thing with most DEX’es is that spreads are wide and slippage is high making for a subpar trading experience. However, Vertex’s hybrid AMM/CLOB model potentially solves a lot of these issues.

There are 3 key features to this hybrid order book-AMM model:

Constant Product AMM (for fully on-chain trading)

Off-chain sequencer for order matching

Fully on-chain risk engine

The AMM allows for fully on-chain trading with support for long-tail assets. Users can also be liquidity providers through the lazy LP management popularised by Unswap V2. The off-chain sequencer supports the order book allowing the DEX to have a performance that emulates the best CEXs. It helps create an efficient execution environment.

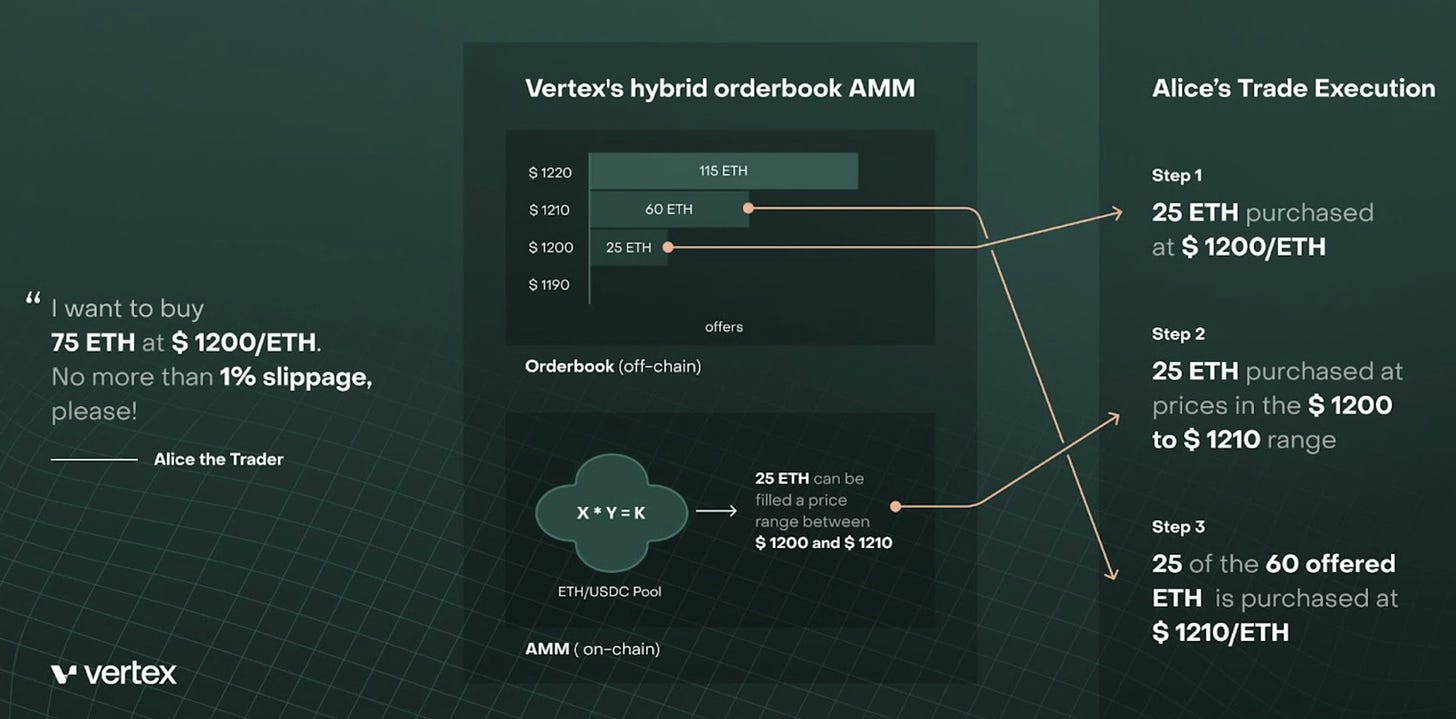

Trades are always executed at the best available price, meaning a trade could fill against limit orders and LP positions concurrently as the sequencer automatically sources the best liquidity available.

The unified AMM + Orderbook liquidity design is extremely powerful for traders looking to execute trades at performant execution speeds and tiny spreads.

This creates several benefits for traders:

- There will always be some liquidity to clear trades against.

- Markets can be seeded with more passive liquidity and flexibility with limit orders - this benefits both illiquid and liquid assets.

- Traders can always trade permissionlessly on-chain without using the sequencer if they wish.

The Vertex sequencer offers order-matching speeds of 10-30 milliseconds. But how so?

This is thanks to their default state called “slo-mo mode”. The AMM pools liquidity gets injected into the off-chain order book which offers much deeper liquidity than other off-chain order books, this allows for much tighter spreads and quicker execution. The orders then go through the highly performant sequencer pathway and are then put on-chain.

In the event that the sequencer pathway goes down, the AMM offers an alternate route for trades to continue. This applies to spot markets as well as per markets.

The protocol also allows for cross-margining positions. Therefore, Vertex maintains the smooth experience and high performance of a CEX while incorporating the transparency and self-custody of a DEX.

Additionally, Vertex are partnered with trading firms such as GSR, Jane St., Hudson River Trading, Huobi, JST capital, and many more. These firms and funds will act as market makers and users of the protocol which is not only a testament to how performant the protocol will be but also having them as market makers will ensure good liquidity, which is a major problem in DeFI.

The features of Vertex Protocol (aka. what makes them unique)

Let’s just list up the features that makes Vertex stand out:

One-click trading (1CT):

1CT enables users to sign one approval transaction at the start of a session and then perform any action within Vertex without needing subsequent approvals.

This experience will be similar to that of CEXs, where users can log-in (sign approval transaction) and start trading without needing to sign for every trade they place. Without 1CT, users must sign multiple transactions when modifying an order or position with linked triggers. With 1CT, the process is automated – delivering the trading experience more akin to a CEX while retaining self-custody.

Lightning-Fast Speed: Vertex is as fast as your favorite CEX with order-matching latency of 10 - 30 milliseconds. Execute trades seamlessly. In the case of maintenance, downtime, or other unforeseen circumstances, the AMM layer on-chain functions as the backstop of the protocol, enabling users to trade solely against the AMM without needing the orderbook.

Vertex is non-custodial: Only you have control over your assets. Take back control from CEXs. Basically, the way this works is that the user deposits USDC or the assets they want to trade into Vertex from their Metamask/Rabby wallet. Now that you’re into the exchange you can use it to trade spot/perpetual or just borrow/lend in the money market. You can at whatever point you want simply withdraw your assets back to your own wallet. I can honestly tell you that this works pretty smoothly. Something Binance/Bybit should learn from this.

Subaccounts: Each address on Vertex can open an arbitrary number of subaccounts, which Vertex treats as an independent account with its own margin, balances, positions, and trades. If liquidated, the only assets at risk are those in a subaccount. Traders with assets in multiple subaccounts do not carry risk between those subaccount.

Trading fees: High fees typically characterize most decentralized exchanges. But Vertex is different. Vertex’s trading fee model is competitive with centralized crypto exchange venues – offering cheap trading for takers and zero fees for makers on major pairs like BTC/USDC and ETH/USDC for both spot and perpetual.

Tokenomics

The main token for Vertex is VRTX. The purpose of VRTX is to act as a governance token for Vertex. There is also a derivative of the VRTX token which is named voVRTX.

Users that stake VRTX also generate the voVRTX token score – a non-transferable sub-type of the VRTX token with an explicit role. Primarily, voVRTX is an incentive lever that mediates a multiplier effect on incentives for VRTX stakers -- proportional to the amount of time their VRTX is staked.

voVRTX is a non-transferable token. Each user will have a certain amount of voVRTX attached to their account which will keep increasing depending on their activity. This voVRTX represents a user's score for boosting. Boosting essentially means that the more voVRTX a user has the more rewards they will get from the pool of assets mentioned above, they will get more voting power, and they will also get cheaper fees when using the platform.

voVRTX boosting is primarily intended to achieve several goals:

Encourage long-term staking of VRTX.

Increase active user participation in the protocol.

Benefit Vertex contributors with long-term perspectives.

voVRTX functions as a boosting mechanism, where incentives for staking USDC.e into the Insurance Fund are eligible for boosting relative to a user’s share of voVRTX. The boost to incentives encourages tokenholders to further participate in protocol health.

Up to 50% of all trading fee revenue generated by Vertex in a single epoch, excluding sequencer fees, will be allocated to the Protocol Treasury and used as rewards. Rewards are subsequently disbursed to users based on their long-term participation and commitment to the protocol (aka. stakers).

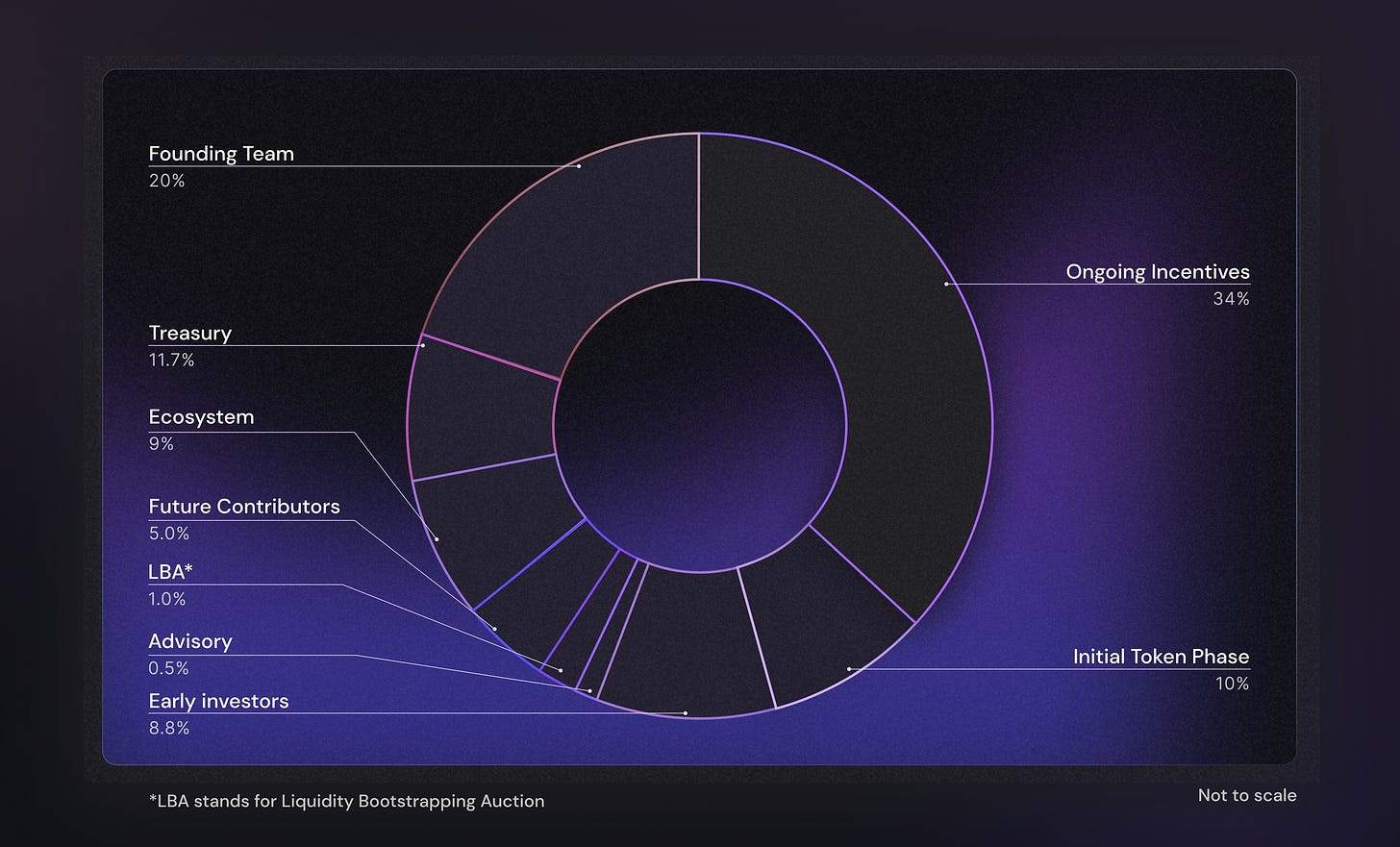

VRTX Token Supply Distribution

As mentioned, VRTX functions as a utility token within the Vertex ecosystem.

There will be a total of 1,000,000,000 VRTX tokens, where 90.85% of tokens will be distributed over a period of 5+ years. The total VRTX supply is fixed.

You can see the supply allocation below:

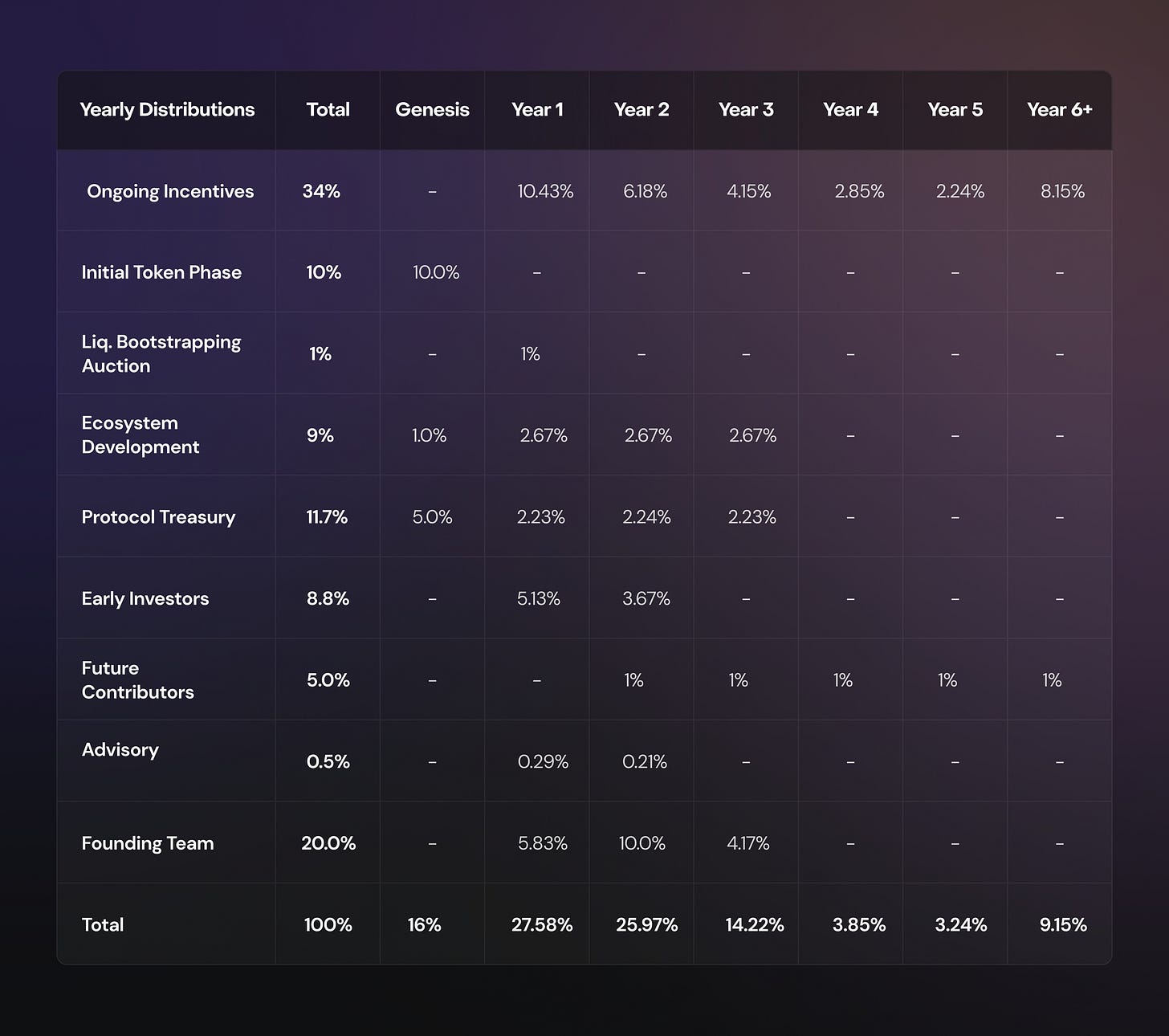

Also, we can see the unlocks below.

The VRTX token emissions (i.e., annualized inflation rate) gradually decrease every year following the Token Genesis Event (The Vertex LBA) until a capped total of 1 billion VRTX tokens have been distributed.

Once the 1 billion VRTX token supply is reached, no more VRTX issuance will occur.

After the 5th year most tokens will be in circulation.

Conclusion

Vertex offers users a frictionless and decentralized trading experience, replacing the need for CEXs and handing control back to the user.

Trade Spot & Perpetuals – Buy and sell your favorite assets. Trade spot on margin or utilize leverage on perpetuals to amplify exposure or hedge risk.

Universal Cross-Margin - Take advantage of portfolio margining. Manage one universal margin account comprising all of your balances and positions to maximize capital efficiency — no more switching between accounts.

Lightning-Fast Speed – Vertex is as fast as your favorite CEX with order-matching latency of 10 - 30 milliseconds. Execute trades seamlessly.

Earn & Borrow - Vertex’s integrated money market lets you earn a yield on deposits automatically. Borrow assets against your margin with multiple collateral types.

Self-Custody – Vertex is non-custodial. Only you have control over your assets. Take back control from CEXs.

Intuitive & Streamlined App - Tap into a sophisticated yet simple UI. Integrated on/off-ramps and bridging, so you don’t need to leave the app.

Pools - Vertex’s hybrid orderbook + AMM design enables users to provide spot or perpetual liquidity to earn fees and $VRTX.

And just to end this I want to include degentradingLSD’s Vertex thesis:

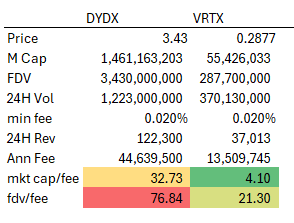

So why $VRTX? Why not $DYDX? Valuation is the first reason

On a FDV basis, $VRTX is ~4x cheaper than $DYDX and on a market cap basis - $VRTX is 8x cheaper than $DYDX. DYDX has 24% of circulating staked while $VRTX has 56% of circulating staked. As you can imagine - this means that there is ONLY 24M USD of liquid tokens available - there is also no perp market for people to push the price down. The orderbook is very THIN.

So whats the valuation for $VRTX then? In my mind, it will be a combination of an L1 + A perp dex + Money market + whichever app they decide to do. In essence - i think this gets to 5B FDV - Or essentially, there is a 20x from here.

TLDR - $VRTX as a perp dex should trade at $1 - $VRTX as an app layer should trade at $5. There is only 24M USD of liquid supply at current prices.

…

All right, I guess that’s it for today. Hope you liked the article and that you got even more bullish on Vertex Protocol.

See you around, anon!

Stay bullish.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

I wonder if $VRTX stakers will benefit from Blitz somehow. Do you have insides about Blitz. Are they planing new token for Blast or not?